Step 17: Interim Payment Certificates

Interim Monthly Statements shall be completed by the Contractor and submitted to the Project Manager of the Project Management Team at the end of the month. The measurement cut-off date shall be agreed with the Contractor (but should be the 25th of the preceding month). The Contractor’s statement shall be accompanied by the backup documents including detailed calculation sheets, measurement sheets, partial drawing clearly showing completed works, materials quality test reports, original copy of price decreased or increased of the base materials for CPA etc. and duly signed by field representatives of both the Project Manager and the Contractor and make payment within 30days of approval of such bill by the concerned authority refer ▬►PPR-2007 Rule-122 and 123; SBD(for medidum contract for construction of bridge)Section IV,GCC: Clause 41: Payment Certificates; PWD, Part-III, Medium Contract, Clause 42 and 43, Condition of Contract, page40, Part-II, Procedural Directives, Chapter-11, Construction Works Sub-chapter 11.5 Payment Procedures pages 11-8 .

PPR - 2007, Rule 122 and 123

122. Information to be Included in Bill or Invoice:

(1) A construction entrepreneur, supplier, service provider, or consultant shall have to include at least the following information in the running bill, any other bill or invoice to be presented by him/her for payment under this Rule:-

(a) Date of bill or invoice,

(b) Name, address of the supplier, construction entrepreneur, service provider or consultant,

(c) Procurement contract,

(d) Description of the delivered goods or services or measurement, size, quantity and price of the works completed,

(e) Terms and conditions of shipment and payment,

(f) Necessary documents to be attached with the bill or invoice as per the procurement contract,

(g) In the case of procurement of goods, the bill or invoice accompanied by shipping or other required documents in the prescribed format by the Public Entity, in accordance with the instructions provided in the purchase order, letter of acceptance of bid and procurement contract, and

(h) His /her contact address.

(2) Upon receipt of the bill or invoice pursuant to Sub-rule (1), the Public Entity shall examine whether the bill or invoice meets the requirements referred to in the procurement contract, and if does not meet the requirements, it shall forthwith notify the information thereof to the concerned supplier, construction entrepreneur, service provider or consultant .

123. Payment of Bill or Invoice:

(1) The procurement contract may provide that in making payment of running bill, any other bill or invoice, the Public Entity may, as per the terms and conditions of contract, make payment in accordance with any or all of the following basis:-

(a) On monthly basis,

(b) On the basis of actual work performed as technically measured and recorded in the measurement book,

(c) If the procurement contract sets forth work performance milestones, upon receipt of such milestones and if such milestone are not set forth, on the basis of the work performed,

(d) On the basis of the quantity of work handed over or completed,

(e) Pursuant to Sub-rule (1) of Rule 122 or on the basis of terms and conditions of the letter of credit.

(2) In order to receive payment of a running bill, any other bill or invoice, the supplier, construction entrepreneur, service provider or consultant shall have to submit the documents required as per the procurement contract.

(3) The Public Entity shall have to make payment, as per the procurement contract, against the bill or invoice submitted pursuant to Sub-rule (1) within thirty days of approval of such running bill, any other bill or invoice and documents by the concerned authority.

(4) In making payment pursuant to Sub-rule (1), the Public Entity shall have to deduct, for retention money, five percent amount of the amount stated in the running bill or invoice and keep the same.

(5) Where a procurement contract provides that upon prompt payment of the amount under bill and invoice by the Public Entity, the supplier, construction entrepreneur, service provider or consultant will provide discount of a certain amount or percentage of such payment, the Public Entity shall provide such payment only after deducting such discount.

(6) In a procurement contract, the Public Entity may provide the following:-

(a) That if in any previous running bill of the procurement contract or any other bill or invoice anything was for any reasons or mistakenly stated necessitates correction of the payment, the Public Entity may, itself or at the request of the concerned supplier, construction entrepreneur, service provider or consultant, correct or change such payment amount in the running bill or any other bill thereafter, and

(b) That if the supplier, construction entrepreneur, service provider or consultant does not perform the work in accordance with the terms and conditions of the procurement contract, the Public Entity may deny or deduct the payment under a running bill or any other bill or invoice.

(7) The Public Entity shall have to make the payment as provisioned under Sub-rule (1) within the period specified in the procurement contract. If it does not make payment within that period, it shall have to pay interest thereon as per the procurement contract provision.

(8) The payments under clause (a), (b), (c) and (d) of Sub-rule (1) to the supplier, construction entrepreneur, service provider or consultant of an amount exceeding twenty five thousand Rupees shall be made through account payee cheque.

SBD

41.1 The Contractor shall submit

to the Project Manager monthly statements of the estimated value of the work

executed less the cumulative amount certified previously.

41.2 The Project Manager shall

check the Contractor’s monthly statement (bill) and certify the amount to be

paid to the Contractor.

41.3 The value of work executed

shall be determined by the Project Manager.

41.4 The value of work executed

shall comprise the value of the quantities of the items in the Bill of

Quantities completed.

41.5 The value of work executed

shall include the valuation of Variations and Compensation Events.

PWD Part III, Medium Contracts, Clause 42 and 43, Condition of Contract

42.1 The Contractor shall submit to the Project

Manager monthly statements of the estimated value of the work executed less the

cumulative amount certified previously.

42.2 The Project Manager shall check the

Contractor’s monthly statement (bill) and certify the amount to be paid to the

Contractor.

42.3 The value of work executed shall be

determined by the Project Manager.

42.4 The value of work executed shall comprise the

value of the quantities of the items in the Bill of Quantities completed.

42.5 The value of work executed shall include the

valuation of Variations and Compensation Events.

42.6 The Project Manager may exclude any item certified in a previous certificate or reduce the proportion of any item previously certified in any certificate in the light of later information.

43.1 Payments shall be adjusted for deductions for advance payments and retention. The Employer shall pay the Contractor the amounts

certified by the Project Manager within 28 days of the date of each certificate. If the Employer makes a late payment, the Contractor shall

be paid interest on the late payment in the next payment. Interest shall be calculated from the date by which the payment should have

been made up to the date when the late payment is made at the prevailing rate of interest for commercial borrowing for each of the

43.2 If an amount certified is increased in a later certificate or as a result of an award by the Adjudicator or an Arbitrator, the Contractor

shall be paid interest upon the delayed payment as set out in this clause. Interest shall be calculated from the date upon which the

increased amount would have been

certified in the absence of dispute.

43.3 Unless otherwise stated, all payments and deductions will be paid or charged in the proportions of currencies comprising the Contract

Price.

43.4 Items of the Works for which no rate or price has been entered in will not be paid for by the Employer and shall be deemed covered by

11.5.2 Retention Money

The retention money should be retained from each of the interim payment certificates as follows:

- The percentage of retention money and the limit of retention money shall be as stated in the contract.

- The retention money shall be obtained from each interim payment certificate.

- An account of retention money both current and cumulative should be included in each interim payment certificate.

Towards the end of the construction period, the retention money should be paid to the

Contractor as follows:

- One half of the cumulative retention money shall be certified for payment upon issue of Taking-Over Certificate with respect to the whole of the works.

- In respect of the Taking-Over Certificate for a section of the works the Consultant shall determine the retention money to be paid to the Contractor in the proportion of the section to the whole of the works.

- The other half of the retention money shall be certified for payment upon the expiration of the Defects Liability Period for the whole of the works.

- If the Contractor has not completed the defects restoration works instructed by the expiration of the Defects Liability Period, the Consultant shall withhold an amount that represents the cost of the works remaining to be executed.

- The withheld retention money shall be included in the final statement.

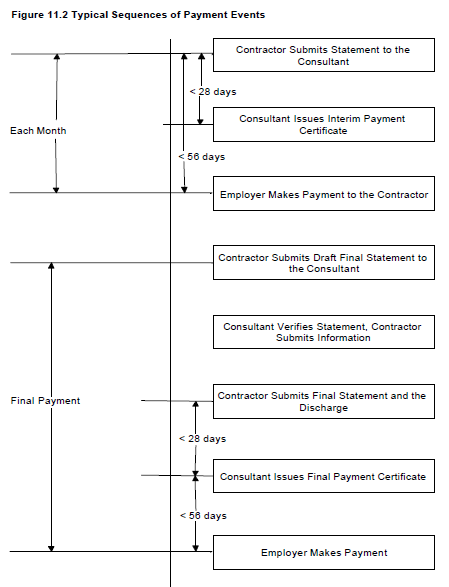

11.5.3 Final Payment

The final payment to the Contractor should be made only after approval of the final statement by

the Consultant and acceptance of the final payment certificate by the Employer as follows:

- The Contractor shall submit a Statement at Completion after the issue of the Taking-Over Certificate in respect of the whole of the works showing in details:

- The final value of works done up to the date of the Taking-Over Certificate,

- Any further sums which the Contractor considered to be due, and

- An estimate of the amount which the Contractor considers will be due to him under the contract.

- The Contractor shall submit a Draft Final Statement after the Defects Liability Period showing in details:

- The value of all works done in accordance with the contractor, and

- Any further sums which the contractor considers to be due.

- Upon approval by the Consultant, the Final Statement shall be delivered to the Employer.

- If a dispute occurs over the Draft Final Statement, the Consultant shall deliver an interim payment certificate for those parts which are free from dispute.

- The Contractor shall give a written discharge notice, which shall be effective only after final payment and return of performance security.

- The Consultant shall certify the Final Payment Certificate stating:

- The amount which is finally due under the contract, and

- Any balance due between the Contractor and Employer.

- The Employer shall not be liable to pay any monies which are not included in the Final Statement and Statement at Completion.

- The payment shall be made to the Contractor within time specified in the contract otherwise the Employer shall pay interest as specified in the contract.